A storm has hit the investment market which we are not going to recover from. Crypto investment is that storm. With strict capital controls in place by most countries to control the flow of money and charge high taxes, cryptocurrency gained usage in circumventing capital controls and taxes, leading to an increase in demand. Cryptocurrency has been able to present an easy to use digital alternative to fiat currencies. Offering frictionless transactions and inflation control, investors have been prudent enough to add these currencies in their diversified portfolios as an asset, as the size of the market does not represent a systemic risk. Cryptocurrency employs the use of cryptography that assures high-security processes and verifies transactions personal to each user. Hence, counterfeiting and anonymous transactions are impossible to achieve.

While this revolution is gaining wide acceptance, Bitbond is the first decentralized business lending platform operating worldwide in more than 80 countries has arrived.

"Before the rise of banks, loans and repayments took place peer-to-peer. People had to trust each other. Over time (perhaps inherent to human nature?) trust began to break down, and intermediaries and third parties were added to the equation. These middlemen provide a layer of protection, but in doing so charge high fees, while adding extra layers of complexity and regulation to the process of lending and borrowing.

Blockchain lending essentially builds on the timeless peer-to-peer model, making the entire process more seamless and reducing the amount of time the process takes. The middleman (a bank) is cast aside, and individual borrowers or businesses are connected directly to willing lenders. The great value of such decentralized lending is that with a single request, a borrower can access very competitive financing, as geography being no constraint on a blockchain platform, lenders from all over the world can bid to provide the loan.

Thanks to smart contracts, lenders are able to validate transactions, verify the legitimacy of counterparties, and perform routine account administration tasks almost momentarily, reducing costs and accelerating the process."

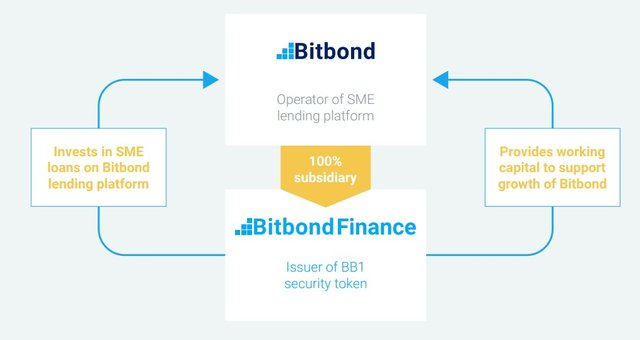

With that being said, Bitbond is already a well-known lending platform with more than 6 years of successful experience in this field and the amount of attracted investments to date is more than $ 1 million each month for business lending. Bitbond offers security tokens that are issued by Bitbond Finance GmbH.

But before we go any further, please check out this video presentation to get even more acquainted

What exactly is BITBOND?

As depicted above and as indicated on the official website of Bitbond, Bitbond is the first global business lending platform. The project belongs to Bitbond GmbH, which is officially registered in Berlin (Germany) and has one of the most worthy financial licenses of the country from the BaFin regulator. For the founders of Bitbond it is a great honor and a tribute from the German regulatory authorities. Given the fact that this is the first blockchain platform in Germany, which received this license.

If you touch a little bit on the history of the Bitbond project, for all these years (since 2013) the company Bitbond GmbH has already successfully established itself and show itself in many countries of Europe and Africa. It has accredited more than 3,000 small and medium-sized businesses worldwide, totaling more than 13 million euros. At the current time, the founders of Bitbond are able to provide monthly loans in the amount of about 1 million euros, which is a worthy result, which the developers assure they do not intend to stop.

The idea of the Bitbond project did not appear by chance, it was preceded by various problems that have met and still occur in all countries of our world. Almost every second small and medium-sized entrepreneur is faced with the lack of adequate funding for their business ideas or a ready-made working model.

Bitbond seeks financial assistance from various banks or other financial institutions. Which in turn do not always have the opportunity to support every entrepreneur.

All Bitbond wants to offer mothers now is to become part of this direction and help to develop business lending to small and medium-sized businesses became more affordable.

Regulated financial institution

Bitbond is a regulated financial institution and is supervised by the German financial regulator BaFin.

Solid returns for investors

Investors on Bitbond currently earn $100,000 interest per month, which Bitbond aim to increase to $2 million by 2020.

Instant Token liquidity

Instantly trade your BB1 Tokens after the STO concludes via the Stellar decentralized exchange.

Blockchain powered global payments

Bitbond connects investors and borrowers from over 120 countries thanks to blockchain powered payment processing.

Automated credit scoring

A proprietary machine learning algorithm allows Bitbond to make credit decisions within 24 hours.

Global partnerships

Bitbond has partnered with several industry leaders to make global financing possible.

To provide the best experience, Germany’s first security token will be issued on the Stellchain blockchain. With a processing capacity of more than 1,000 transactions per second, transaction costs on a fraction of a cent, built on decentralized exchanges and a global network of active partners using the platform, Stellar is one of the most efficient blockchains for processing payments and publishing tokens.

The BB1 security tokens are created on the basis of the Stellar Lumens blockchain and will be distributed by means of STO, as well as work with all online wallets that support this blockchain.

About BB1 Token sale

Security Token

BB1 is a security token issued by Bitbond Finance GmbH (Bitbond subsidiary)

Bitbond Finance’s STO prospectus is fully compliant with EU Prospectus Regulation.

Accepted Currencies

Euro (SEPA) Stellar (XLM) Bitcoin (BTC) Ether (ETH)

Discount Code

Use BB1STO to enjoy a 3% discount on your BB1 tokens!

Maturity

Bitbond Finance will buy back the token at the original price of €1 after 10 years.

Issue

Tokens are only generated if they are bought.

The use of borrowed funds is as follows:

Till next time…

For more information, please visit:

Website: https://www.bitbondsto.com

Lightpaper: https://www.bitbondsto.com/files/bitbond-sto-lightpaper.pdf

Prospectus: https://www.bitbondsto.com/files/bitbond-sto-prospectus.pdf

ANN thread: https://bitcointalk.org/index.php?topic=5130337.0

Telegram: https://t.me/BitbondSTOen

Facebook: https://www.facebook.com/Bitbond/

Twitter: https://twitter.com/bitbond

Medium: https://medium.com/bitbond

Reddit: https://www.reddit.com/r/BitbondSTO/

Instagram: https://www.instagram.com/bitbondofficial/

YouTube: https://www.youtube.com/user/Bitbond

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2487106

My Bitbond Affiliate link: https://www.bitbondsto.com/?a=HVBTCU

Disclaimer: This article was published in terms of the bounty campaign. I am not a project team member or its representative but a supporter of this incredible project.

Comments

Post a Comment