PCORE - The Innovative Invoice Discounting Platform for Businesses and Investors - The Cryptocurrency For Payments

With strict capital controls in place by most countries to control the flow of money and charge high taxes, cryptocurrency gained usage in circumventing capital controls and taxes, leading to an increase in demand. Cryptocurrency has been able to present an easy to use digital alternative to fiat currencies. Offering frictionless transactions and inflation control, investors have been prudent enough to add these currencies in their diversified portfolios as an asset, as the size of the market does not represent a systemic risk. Cryptocurrency employs the use of cryptography that assures high-security processes and verifies transactions personal to each user. Hence, counterfeiting and anonymous transactions are impossible to achieve.

While this revolution is gaining wide acceptance, Pcore, a P2P (peer to peer) invoice discounting platform integrated in the blockchain technology, with the aim to combine transparency, trust, speed and security of the blockchain with registered smart contracts and directly bring together invoice sellers and lenders has arrived.

"The world of business has been and will remain quite complicated, which is associated with technological progress. Operational processes are evolving at unprecedented speed, involving even more new figures than ever before. Competition is fierce, while customers demand quality and attractive pricing programs. These programs rely on financing bills more than ever before to attract more potential customers.

Financing invoices (A / R), as a term, is not new in the business world, as it provides a steady stream of income for companies. This is a form of contract between the buyer and the seller, in which the customer has the opportunity to pay for the goods later. Usually a 30, 60 or 90-day notice provides the buyer with the opportunity to pick up selected goods or services, while the company has a steady income for a certain period of time. However, as soon as the transaction is concluded, the enterprise in question also suffers from liquidity, since it can only receive debt later.

At the same time, the emergence of blockchain technology has sparked a growing interest from organizations around the world. Decentralized networks, globalized cryptocurrencies and smart contracts all play their part. However, probably the most distinctive feature that the blockchain offers is the security of translations. The system itself, through smart contracts, has the ability to improve the integrity of transactions, ensuring that all parties must act in accordance with their promises of transfer."

With that being said, Pcore Ltd. offers a market that can significantly increase the liquidity of business customers. Through the blockchain network developed by the project team, we are offered a market where customer accounts can be safely sold. The platform allows enterprises to connect, load and issue trade bills, improving the liquidity of companies, providing a good investment platform for companies that are looking for secure financing projects.

But before we go any further, please check out this video presentation to get even more acquainted

What exactly is PCORE?

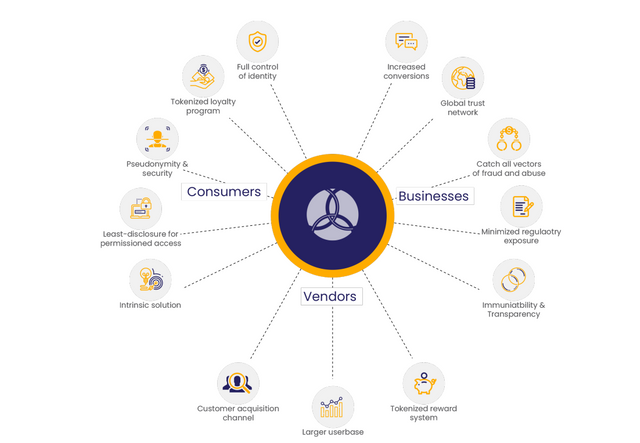

Pcore a P2P (peer to peer) invoice discounting platform integrated in the blockchain technology, with the aim to combine transparency, trust, speed and security of the blockchain with registered smart contracts and directly bring together invoice sellers and lenders.

At Pcore LTD we aim to combine todays technology into a niche but growing market. As more businesses are turning to other alternatives of funding other than banks, we want to bring them a platform which they can trade their invoices for faster means of obtaining their due amount. In return helping them expand, grow and keep up with business costs.

Pcore is an end-to-end platform that will provide SMEs with easy access to short-term financing, turning their receivables into tradable assets. With a 24-hour turnover, interest rates allow lenders to make a profit, while sellers receive vital liquidity for their daily operations.

Pcore platform supports issuers, owners and payers. Therefore, invoices can be available as a general source of liquidity for factoring. By loading the income date, lenders will be able to choose the length of the factoring and the interest rate involved in the smart contracts. Tokens will connect sides from around the world, ignoring boundaries in this process.

However, only the firm or the recipient of the invoice can provide access to detailed financial data about a particular company or invoice. This allows for real-time auditing, improves the credit scoring process, and speeds up loan approval. Those companies with a positive credit history will attract creditors more easily, while the incentives will be available for use as part of their operations. The algorithm is based on XBRL company data and risk assessment results.

The Problem

We base our business on real life problems in various industries. Thus, Pcore aims to solve the obstacles and problems faced by modern companies when dealing with liquidity and financial uncertainty. Apart from that the main problems that disrupt a number of markets for some at regular bases are financial & factoring constraints, invoice verification, and non-transparent / outdated financial reports.

Financial Limits & Factoring

SMEs have limited access to short-term financing (working capital). Banks demand significant guarantees and large amounts of documentation when approving financing projects, especially after the last recession in 2009. This represents a large funding gap for small and medium-sized companies worldwide, driving the growth of the global factoring industry by 10% each year. Current estimates indicate that the factoring invoice market has a value of US $ 3 trillion in 2018, making it a large enough market to be investigated.

Since the beginning of the financial crisis in 2009, factoring in the United States and around the world has grown between rates of 11% and 24% per year, adding more than one trillion euros in annual factoring volumes in less than a decade. This industry practically doubled its size, even though the modern era of factoring began only a century ago.

SMEs are clearly in a disadvantage when dealing with the capital market in terms of credit rationing and financial inequality, due to lack of financial strength. The gap in financing has driven the need for alternative financing sources, such as factoring.

Invoice Verification

There are several steps needed when verifying the authenticity of the invoice sent. This includes confirmation that the invoice service was actually sent as claimed, operating inspection that has a direct relationship with the invoice service, and an investigation of the materials used to meet the specified requirements where the invoice is built.

With the implementation of an ERP system, Pcore intends to automate all processes involved in the analysis of validity, making checkpoints that the user must take when verifying the authenticity of potential partners. The history of invoices sent by the company to the public allows automatic assessment of validity and further related risks.

In modern business, automatic checks are almost impossible without constant physical inspection. In addition, notes can be falsified, further limiting investors to uncover foul play when that happens. Because there is no real incentive for companies to disclose their direct finances to the public, there is a high probability of incorrect financial results.

Non-Transparent and Old Financial Statements

Problems with financial statements that are not transparent may be as old as the business itself. There are several reasons why companies want to hide their true results, especially when invoices are questioned. Business plans and financial statements, in general, must show the financial health of the company now and in the past. However, by removing key data or even manipulating their presentation, the company in question seems to be in a good position, while the actual situation is very different.

Although the government actually enforces basic financial presentation guidelines through IFRS and GAAP policies, many companies continue to find ways to bypass them. The IFRS model represents a step forward when it comes to bribery investigations and illegal activities. However, it cannot explain all the possible places where non-transparent reporting is questioned, especially when SMEs are involved. Factoring needs invoicing has increased in recent years, with businesses emerging in the SME sector. However, the problem still concerns trust and accurate reporting.

The Solution

As a format for presenting financial data on a platform, we chose XBRL (eXtensible Business Reporting Language). This framework represents open international standards for digital business reporting. This is used throughout the world, with companies from more than 50 countries implementing it in their operations. Millions of XBRL documents are created every year, replacing older, paper-based reports with useful, effective and more accurate digital reports.

In other words, XBRL provides a language where the term reporting can be clearly defined. In turn, the term can then be used to uniquely represent financial report content or other types of compliance, performance, and business reports. XBRL is often called “bar code for reporting”, because it makes reporting more accurate and efficient. With unique tags, XBRL enables Pcore to develop its platform according to sophisticated market requirements, providing:

Usable reporting documents that can be registered, sorted, and analyzed automatically by Pcore

The general belief that all reports in the platform follow up are sophisticated, predefined definitions

In addition, comprehensive definitions and accurate data tags will help parties to carry out various reporting tasks, including:

Preparation

Validation

Publication

Exchange

Consumption

Risk analysis and business information performance.

To enable the exchange of business report summaries, XBRL applies transaction tags on the platform. This transactional representation allows the exchange of independent systems and analysis of large amounts of supporting data. Thus, as a key to the transformation of financial reporting, the Pcore platform uses two core calculations to support investors in evaluating investment opportunities.

Token Details

Token Name: PCORE

Tricker: PCC

Project Category: FACTOR FACTORING PLATFORM

Project Type: TOKEN

Project Platform: ERC – 20

Limited country: CHINA, USA

Basic Token Price: 1PCC = 0.39USD – 1PCC

Receive: ETHEREUM

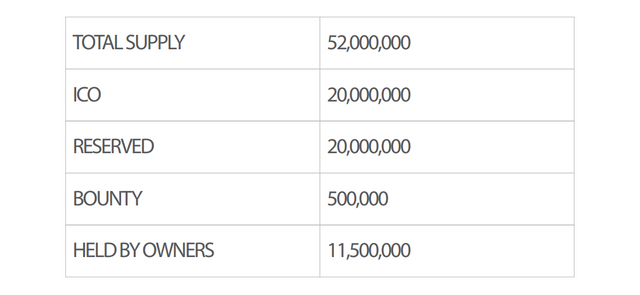

Token for Backup: 20,000,000

Tokens for sale: 20,000,000

Bounty: 500,000

Tokens Reserved for Teams: 11,500,000

Soft Cap: 1.000.000 USD

Hard Cap: 5.000.000 USD

At present we are in the Crowdsale which only accepts Etherium (ETH) as all forms of payment. You cannot use an existing Exchanger but you can only use the Etherium address from ERC20. The sales results in the form of Ethereum will be reused to develop the project and build a blockchain-based invoice discounting platform system using PCC tokens as an exchange unit.

March – April 2019

Pre ICO bounty.

Within our marketing campaign we have considered the effectiveness and influence of social media content creators.

We Have decided to pay selected social media influencers within the crypto community based on their content engagement and promotion of Pcore (PCC).

Working with security auditors to finalise ICO contract.

May – June 2019

ICO.

20 million (PCC) will be on offer for investors.

ICO sale coins released.

PCC sold in pre-sale and ICO will be released to investors. Further information and updates will be announced through twitter.

Exchange listing.

July – September 2019

New office site.

Reaching the end development of the invoice trading platform with the hired software developers to perfect the functionality and use for business and investors.

October 2019

Launch invoice trading platform.

December 2019 – January 2020

Start of building invoice software for China.

March 2020

Pcore software launch date.

April – May 2020

Start market research for penetration of Pcore into China. Integrating and testing Pcore software into Chinese invoicing market.

June 2020

Marketing campaign start for Pcore platform in China.

July 2020

Explore new markets.

Explore new software development for invoicing.

MEET THE AMAZING TEAM

Sezgin Aydin: Founder / CEO / Director

Akin Aydin: Co-founder / Marketing Manager

Vang YangPao: Co-founder / Development Manager

Be a part of this incredible project. Download the whitepaper for the full scoop.

Till next time…

For more information, please visit:

Website: http://www.pcore.co/

Whitepaper: http://www.pcore.co/whitepaper

ANN Thread: https://bitcointalk.org/index.php?topic=5121997.msg50244695

Facebook: https://www.facebook.com/Pcore-PCC-351650118758061/

Twitter: https://twitter.com/PcorePCC

Telegram: https://t.me/joinchat/Lr_g4hNZ8vDU0qiwzAwH5A

LinkedIn: https://www.linkedin.com/company/35598943

My Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2487106

Disclaimer: This article was published in terms of the bounty campaign. I am not a project team member or its representative but a supporter of this incredible project.

Comments

Post a Comment